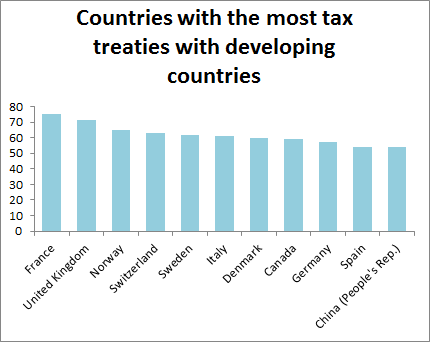

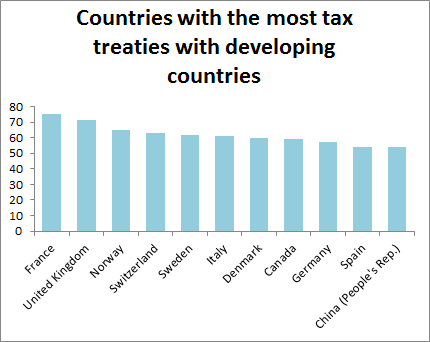

Here’s an interesting chart. Do you notice anyone missing? Interestingly, the United States is considerably less keen on signing tax treaties with developing countries than you might expect, given the amount of investment from it to, well, most places. Its only treaty with the whole of sub-Saharan Africa is with South Africa. When I looked in the wikileaks cables (of which more another day) it’s clear that many more developing countries want tax treaties with the US than get them.

I can think of a number of reasons for this. Perhaps colonial ties have bumped up the number of treaties signed by countries such as France and the UK. Perhaps the US system of deferral encourages the use of intermediate jurisdictions to structure investments, which in turn reduces the demand for direct bilateral agreements. When I asked people who know about what goes inside the US Treasury, they tend to cite limited civil service capacity as the main constraint, but I don’t get the feeling that the US has a lot less capacity than anywhere else.

The other thing I’ve heard, which sounds more plausible (or at least more interesting), is that in the US, tax treaties have to be ratified by a two-thirds majority of the Senate, and that can be a rocky ride. There are currently several treaties pending, Senator Rand Paul having made an issue out of the US-Swiss treaty. The Senate has been known to reject elements of tax treaties, including for example anti-abuse clauses in treaties with Italy and Slovakia. You can see the level of detailed examination in this report of the Senate Foreign Relations Committee.

It’s not just the US, however: the French senate rejected a proposed tax treaty with Panama a few years ago. This level of control must surely drive treaty negotiators mad, and I can quite imagine it acting as a brake on negotiations (though not, it seems, in France, which is at the top of the chart above). But surely it’s in everyone’s interests for the legislature to interrogate international tax instruments before they become law, rather than afterwards, as has happened with the Public Accounts Committee in the UK?

Well, speaking of the UK, I took a quick look at what happens here. Tax treaties are first scrutinised by the House of Commons’ delegated legislation committee, before being passed without a debate in the full house. So what does that scrutiny committee do? It turns out they have a nice little chat and then everyone votes in favour. For example, how long did it spend on 29 November 2010 considering six treaties with Belgium, the Cayman Islands, Georgia, Germany, Hong Kong and Malaysia? 25 minutes. Hungary, Armenia, Brazil, Ethiopia, and China on 1 November 2011? 25 minutes. Bahrain, Barbados, Singapore, Switzerland and Liechtenstein on 5 November 2012? 28 minutes.

In all cases, the treaties are passed with cross party consensus, perhaps in part because many were negotiated when Labour were in power. To be fair, there is a small amount of probing. When the treaty with Switzerland is discussed, a couple of backbenchers raise tax avoidance issues, while not at any point appearing to question the treaty itself. And there is this exchange during the 2011 session:

The Exchequer Secretary to the Treasury (Mr David Gauke): […] The hon. Gentleman raises a number of detailed questions. Let me try to address them as best I can. His first question is part of the tradition of these debates, which is to ask how much will be saved and what the financial benefit is of these agreements. It is part of the tradition, because it is a question that I asked on several occasions, and, whoever has been standing in the Minister’s position, the answer has consistently been the same: it is not possible to give a precise number for the revenue effects of these agreements—or indeed of other double taxation agreements. The overall cost or benefit of an agreement is a function of the income flows between the two countries, and the agreement itself is likely to change both the volume and nature of those flows by encouraging cross-border investment. It can be somewhat difficult to make any predictions about the impact of any one agreement.

Clearly, there is consensus on the point that it is in the UK’s interest to have an extended number of double taxation agreements, and the fact that we have such an advanced set of agreements is one of the advantages that the UK offers to international—multinational—businesses, but, as I say, it is not possible to identify particular sums.

Owen Smith: I fully accept the Minister’s point about the difficulty of prospectively projecting precise revenues, but does he feel that taken together these agreements—the Chinese one in particular—are revenue-positive for the UK?

Mr Gauke: I can go so far as to say that, in the round, these agreements are beneficial to the UK as a place to do business, and that that in itself has revenue advantages, but it is difficult to say whether each individual agreement works out revenue-positive or negative. In truth, it is not a zero-sum game. As with all international trade, there are advantages to being an open, outward-looking economy and to trading with other countries. The UK will benefit from being able to do that, and our advanced set of double taxation agreements will play a role in it.

And that’s the end of the matter. From this brief survey, I can’t tell whether this rather lacklustre scrutiny in parliament is a temporary blip, whether the Labour party are being a particularly compliant opposition, or whether this is how it has always been.

It is, however, more than occurs in many developing countries, where tax treaties can often be ratified by the executive without any legislative approval. That includes India, whose parliament has been powerless to change the controversial treaty with Mauritius. And even in countries where there is a vote, the tax officials I’ve spoken to say it usually descends into mud-slinging about all kinds of tax issues. After all, this is technical stuff that would require MPs to do a lot of homework, and is unlikely to catch the public imagination.

Getting the right balance is tricky. But tax treaties are not just arcane bits of bureaucracy, they’re actual tax policy, setting the tax rates paid by taxpayers and thus affecting the amount of public revenue available, as well as tax equity issues. And that deserves a proper scrutiny.

Excellent article Martin. Very interesting.

Thanks Daisy!