One big theme from the interviews I conducted on my recent African trip is that tax officials in developing countries are really starting to raise concerns about some of their tax treaties. This is particularly true of treaties with the Netherlands, Mauritius and other countries that can leave them vulnerable to treaty shopping, although it doesn’t stop there.

Why are you thinking about this now? I asked. One finance ministry official told me that there had been three factors: first, seeing countries such as Mongolia and Argentina cancel some of their treaties; second, recent NGO reports that had focused on the abuse of tax treaties, in particular the ActionAid report on Zambia sugar; third, the growing body of practical experience inside the country’s revenue authority.

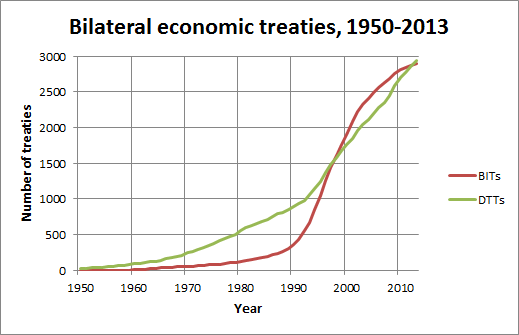

If developing countries are watching what each other does, as well as learning from their own experiences, that’s interesting for international relations. It means we can draw direct parallels with Bilateral Investment Treaties (BITs), where a similar process has been studied in a lot more depth. This first chart compares the growth in BITs and tax treaties (DTTs) over time.

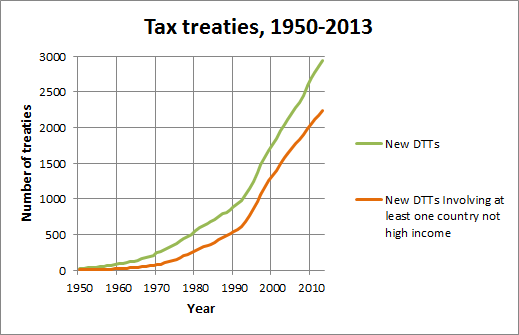

Whereas the number of tax treaties is still on the upward slope of a comparatively gentle exponential rise, investment treaties went through an explosive period in the mid 1990s and early 2000s, before tailing off almost to zero. (By the way, bilateral investment treaties are usually signed by developing countries, since this is the situation where investors are most concerned about possible appropriation of their investments by governments. The chart below shows that the overall pattern for tax treaties is the same if you only consider treaties signed by developing countries)

Whereas the number of tax treaties is still on the upward slope of a comparatively gentle exponential rise, investment treaties went through an explosive period in the mid 1990s and early 2000s, before tailing off almost to zero. (By the way, bilateral investment treaties are usually signed by developing countries, since this is the situation where investors are most concerned about possible appropriation of their investments by governments. The chart below shows that the overall pattern for tax treaties is the same if you only consider treaties signed by developing countries)

The now-classic explanation for this pattern of “three waves of diffusion” of BITs is as follows [pdf]:

The now-classic explanation for this pattern of “three waves of diffusion” of BITs is as follows [pdf]:

In the first period, BITs provided a solution to the time inconsistency problem facing host governments and foreign investors. In the second period, these treaties became the global standard governing foreign investment. As the density of BITs among peer countries increased, more countries signed them in order to gain legitimacy and acceptance without a full understanding of their costs and competencies. More recently, as the potential legal liabilities involved in BIT signing have become more broadly understood, the pattern of adoption has reverted to a more competitive and rational logic.

Lauge Poulsen and Emma Aisbett present some pretty convincing evidence that the tailing off of BIT signatures in that “third wave” came as countries started to see the consequences of their actions in the form of claims made by investors. Their study suggests that countries only really learned from their own experience, or to a lesser extent from that of other countries in their own region: their field of vision didn’t extend much further than this.

I think there are three relevant points for the comparison between tax treaties and investment treaties. First, there has been no significant tailing off in tax treaty signings yet, which is consistent with the fact that there has not been the same volume of high-stakes disputes resulting from tax treaties as there has been over investment treaties. The comparison seems to offer support for Poulsen and Aisbett’s argument.

Second, this might change. Like BITs, tax treaties result in occasional disputes over large amounts of capital gains tax, as I wrote about recently in Uganda’s case. But tax treaties also have an ongoing cash cost to a developing country government in lost withholding tax and corporation tax. This includes the amount that is sacrificed directly to businesses from the treaty partner, but it also includes additional amounts lost through treaty shopping and transfer pricing structures, such as those documented in the ActionAid report and last year’s report produced by SOMO on Dutch treaties.

The question is whether only high profile cases with large amounts at stake – in other words capital gains disputes and reports by NGOs – are enough to cause developing countries to review their approach to treaties, or whether decisions might also be made on the basis of that ongoing cash cost. In fact, I think most of the instances of treaty cancellations have been for the latter reason. Certainly that appears to have been the rationale behind Mongolia’s decision to cancel treaties with several European tax havens [link is in Mongolian], as well as Indonesia’s decision to cancel with Mauritius. Where there wasn’t a dramatic case to catch policymakers’ attention, what provoked countries to reconsider their tax treaties?

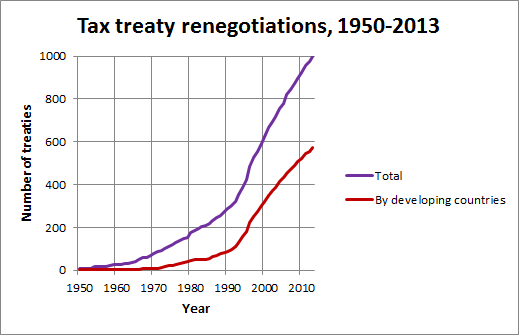

A third point for comparison is that there is actually a fundamental difference between investment treaties and tax treaties. The whole point of the former has become to give investors recourse to arbitration, the very thing that then caused developing countries to stop signing. In contrast, what generally leads to concerns about tax treaties is when they are abused in tax planning structures, something that can be prevented through a well-negotiated treaty. Tax treaty cancellations have generally come about when requests to renegotiate fail (the above Mongolian link says the Netherlands and Luxembourg cancellations happened because of lack of progress with renegotiations) or as tactics to bring the other side to the table (Argentina-Spain and Rwanda-Mauritius are both examples of treaties cancelled by a developing country and then subsequently renegotiated).

The upshot is that with tax treaties we may not see a wave of cancellations, or a slow-down in negotiations, but rather a wave of renegotiations, something that is already ticking along in the background.

Note on data: I compiled the numbers of tax treaties from the IBFD database. The numbers only include treaties that have been signed (including treaties that have been signed but not ratified, and excluding treaties initialled but not signed). They exclude treaties signed by jurisdictions that were not fiscally independent at the time (no treaties signed by colonies, except for British and Dutch overseas territories that set their own economic policy). Numbers of investment treaties were taken from UNCTAD, and compiled by Lauge Poulsen.

Note on data: I compiled the numbers of tax treaties from the IBFD database. The numbers only include treaties that have been signed (including treaties that have been signed but not ratified, and excluding treaties initialled but not signed). They exclude treaties signed by jurisdictions that were not fiscally independent at the time (no treaties signed by colonies, except for British and Dutch overseas territories that set their own economic policy). Numbers of investment treaties were taken from UNCTAD, and compiled by Lauge Poulsen.

The more I read your blog the more I feel like I know absolutely nothing about tax. And I have been studying it since 2008! May Hen